- March 25, 2022

- Admin Wiseinvestor

- 0

Can you tell me what the source of our drinking water is? For people of Kolkata, it is the water of Ganga, for people of Delhi, it is the river Jamuna, or boarding water, etc. We all know that.

Just think, can we pick up a glass and drink that water directly from the river!!? Definitely not, because it is polluted, it is full of germs, irons, particles, bacteria, etc. We process the same with a water treatment plant or FILTER that removes the all harmful elements in it and improves the quality of water to make it appropriate for drinking.

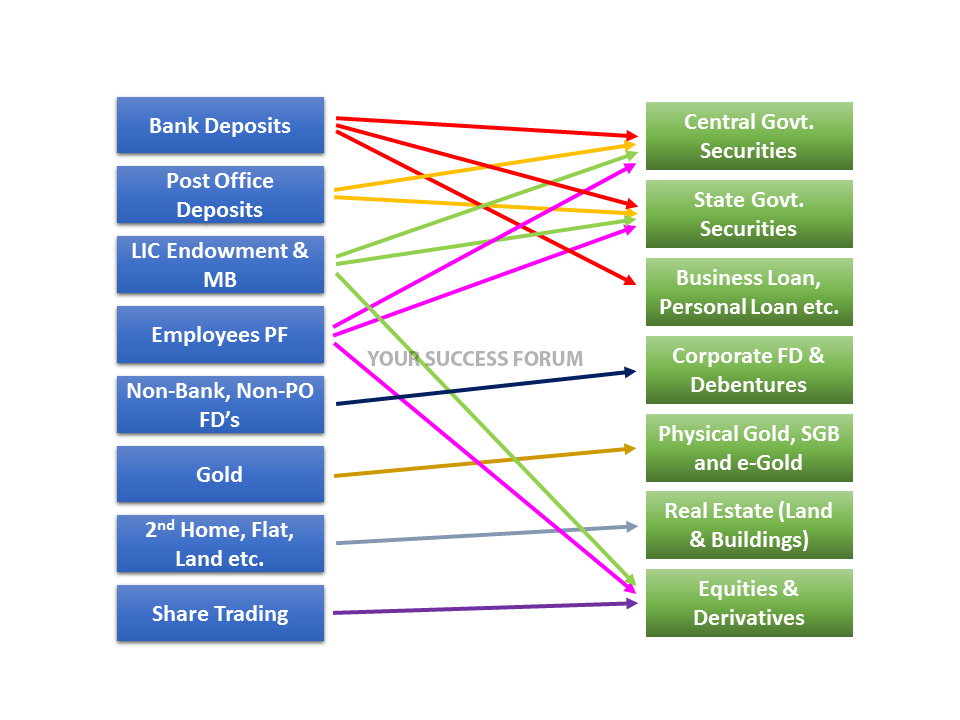

Similarly, whenever it is a matter of investing, we have the option to invest directly in Fixed Deposits, Bonds, Debentures, Gold instruments, Real Estate, Equities, Derivatives, etc. Generally, we think all these direct products are clean, but is it true!? You must be thinking, how an FD, Bond, Debenture, etc. could be dirty!? Yes, it could be, if one has not checked risks with any particular investment, which we generally overlook.

As a common investor where we generally park our savings to fulfill our financial needs and goals?

And, what is the ultimate destiny of these funds (apparently)?

Let’s see the associated risk with all these investments?

| Investment Avenue | Major Associated Risk |

| Equity | Highly Volatile / Market Risk, Concentration Risk |

| Real Estate | Liquidity Risk, Big Ticket Size, Litigation Risk, Concentration Risk |

| Gold | Volatility / Market Risk, Exchange Rate Risk, Concentration Risk |

| Bond / Debentures | Interest Rate Risk, Credit Risk, Concentration Risk |

| Fixed Deposits | Credit Risk, Concentration Risk |

*Inflation Risk is associated with all investments, but only equity has the potential to beat inflation over a long term.

Now, how can we mitigate these risks? E.g.

Equity: We have very limited resources and time to deep research on companies where we are investing. Will, it is not good if someone professional is research work at a low cost, and if we can reduce the volatility and diversify your investment?

Real Estate: How it would be if we can invest across different geographical locations sitting at home with small ticket sizes?

Gold: If we can participate in gold only when its valuation is attractive or available at a low cost? And further, if no locker, no making charges, no GST is required!?

Bond / Debenture / FD’s: If we can judge the paper which is safer but having a little bit higher rate of interest? Will, it is not good, if there is something that filters and removes pongee schemes?

Here Mutual Fund steps in as a Filter Machine, which mitigates all such risks associated with direct investments and diversifies your investment. Their research team always tracking the performance of the company, sector, and asset class where they have invested, which reduces the uncertainty. Stringent compliance and core monitoring process mitigate investment risks in:

- Businesses having weak management

- Loss-making companies

- Companies that is losing their market share

- Businesses are in Debt Trap

- Businesses who are not accepting changes and new technology

- Companies having lower Credit Rating (below the investment grade)

- Companies facing tuff challenges in Litigations